ADV

Lifetime Rewards (₳)

ADV2

Lifetime Rewards (₳)

ADV3

Lifetime Rewards (₳)

ADV4

Lifetime Rewards (₳)

ADV has been in operation since epoch 208 at the start of Shelley and has the largest lifetime ADA rewards, then ADV2 (epoch 237), ADV3 (epoch 251), and ADV4 which is under development.

Since starting operation our stake pools have generated rewards of more than million ADA for our delegators, with our Annual Percentage Yield averaging % across all pools. Careful attention to operations and technical design means our rewards are among the very highest available.

ADV

bn

k

mn

%

ADV2

bn

k

mn

%

ADV3

bn

k

mn

%

ADV4

bn

k

mn

%

1APY (Annual Percentage Yield) is calculated by annually compounding average lifetime return per epoch:

lifetime return = (lifetime rewards – lifetime fees) / lifetime stake

Compounding assumes all epoch rewards are staked (73 epochs * 5 days = 365 days).

Reward lifecycle

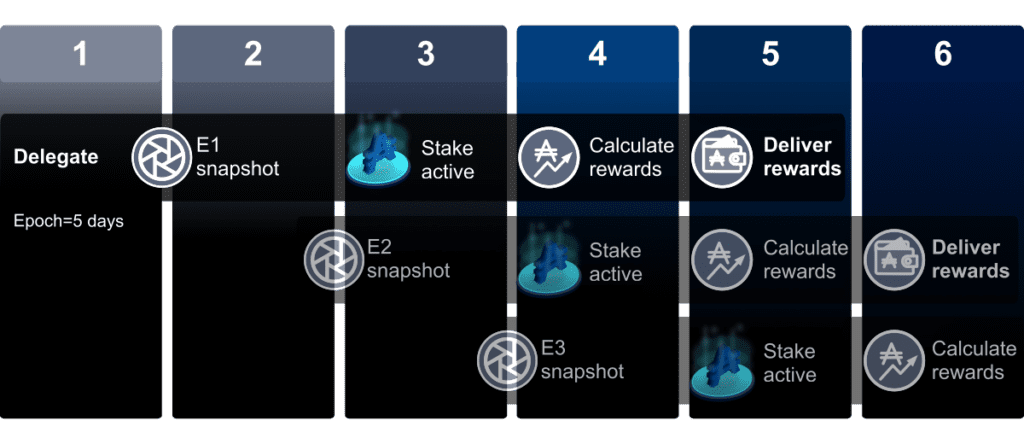

The staking and rewards process is divided into 5 day epochs, with a snapshot to capture status at the end of each epoch. It takes 4 epochs from choosing a pool and delegating your ADA, to receiving your first rewards at the beginning of the 5th epoch.

This means there will be a lead time of 15-20 days before rewards start flowing into your wallet (depending when you delegate in the initial epoch). You will continue to receive rewards from the pool for 3 epochs after you stop delegating or move to another pool

How are rewards calculated?

Pool rewards are calculated every epoch, adjusted for performance (a pool forging all allocated blocks will make 100% of expected rewards), then distributed to the pool operator and delegators. This happens in several steps:

- First, the fixed and variable fees (₳340, 0%2) are subtracted from the total rewards and transferred to the pool operator.

- Next, the remaining rewards are split fairly (proportional to delegated stake), amongst all delegators.

Please note:

- Fixed and variable fees are only deducted if the pool forges blocks.

- Fees are shared proportionately by all delegators based on their stake. If you have 0.1% of the total stake your fee/epoch will be:

0.1% x ₳340 = ₳0.34 - There is a one time deposit of ~₳2 which is refunded when you stop delegating. The delegation transactions are subject to the minimum network fee of ₳0.17.

ADAvault fixed and variable fees are among the lowest available.

2 0% introductory offer until December 31st 2025.