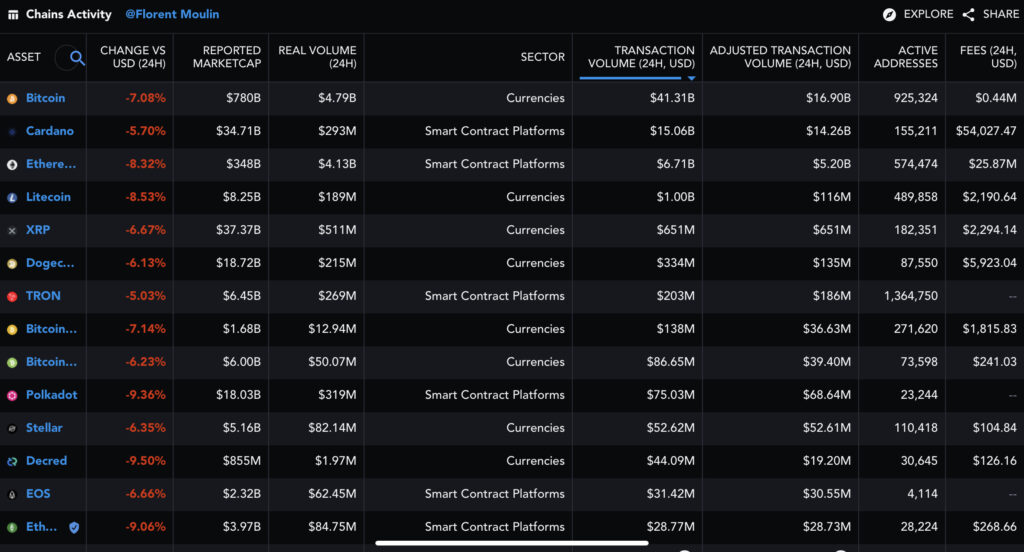

So lets take a moment to examine this table from Messari. Spot the interesting and very important data point?

Cardano has been in second place for Transaction volume for about a week now (it actually surpassed Bitcoin at one point). Of note:

- Bitcoin and Cardano are running neck and neck at $16.9B and $14.3 respectively.

- The next closest is Ethereum at $5.2B, then XRP at $0.6B.

- After that the numbers drop off quickly.

Adjusted transaction volume removes irrelevant transactions (exchange wallets for example), wash trading and other techniques which are sometimes used to artificially inflate transaction values.

So what does this tell us? Primarily that Cardano is delivering real world utility to people. Remember Cardano has only just moved into the Smart Contract era and it’s already challenging the leader. The major scaling improvements of the Basho era (which we are now in) are yet to be delivered, and we are due to see another 5+ major DEXs launch in the coming year. Side chains like Milkomeda have yet to go live. Bridges to other chains like Ethereum have yet to go live.

This indicates that we could easily see the transaction volume double, quadruple or even more in the coming 6-12 months which would put Cardano comfortably in the lead. And while transaction volumes are high, fees are low. This is the corollary of the utility point made earlier. High transaction costs are a significant inhibitor to real world use. Cardano has very low fees, which nonetheless cover the operational costs for the chain, and provide funds for treasury.

Let’s acknowledge that we currently see chain congestion due to demand, but it is handled reliably, and we avoid the unpredictability of a fees market. The tiered pricing model will offer a fair approach to this in due course (more on this in a Blog post soon). As we have noted previously high demand is a nice problem to have.

We are going to stay away from price predictions (as ever), and would simply note that over the long term price always follows utility. In terms of utility Cardano is delivering on it’s design goals. In fact, you could argue that is smashing them out of the park.