A busy week in the crypto markets, triggered by the collapse of the StableCoin Terra and the non stable reserve Luna, has led to some soul searching by commentators, and a lot of articles in the main stream media predicting the imminent demise of cryptocurrencies (again).

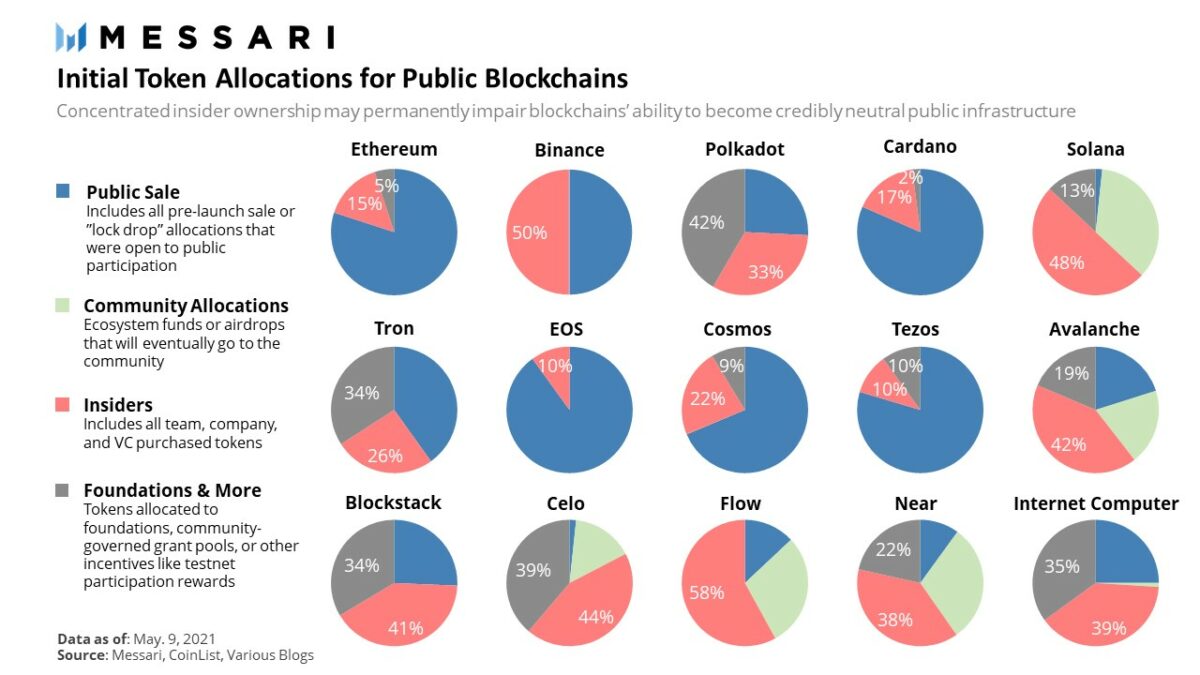

But was it surprising? For us the answer is a resounding no. The initial token distribution for Luna, which had no public sale and was 100% owned by insiders, was a red flag from day one. There were many others such as the inherent instability of the system if the market cap of Luna ever dropped below Terra.

At the time of writing there is a lack of transparency on what has happened to the $3bn BTC reserves held by the Luna Foundation (and under the control of the founder), and answers have not been forthcoming1. Were they fully used to defend the Terra dollar peg, or are some remaining? Many investors in Terra/Luna have effectively lost everything with no recourse2.

So why does the initial distribution matter in this regard?

- The more of the supply that is sold to the public on day one, the less opportunity for subsequent artificial price manipulation.

- If the token distribution is fair and unbiased it prevents undue influence in decision making over future direction for the project.

- For Proof of Stake chains a wide distribution is very important to prevent 51% attacks.

- Retail investors are not simply providing exit liquidity for insiders which helps build a stronger community.

Cardano has one of the fairest distributions of public blockchains, improving on Ethereum, and similar to Bitcoin. This is critically important to ensure security of the blockchain and ensure that all participants have fair access to the ecosystem and an opportunity to benefit.

In our view there are a very small number of trusted blockchain projects which have fair tokenomics, including Bitcoin, Ethereum, Cardano and Ergo. We strongly recommend that you carefully examine the details for any investments that you make.

Cardano also has very carefully designed emission of new tokens for staking which is designed with diminishing rewards. It has the same programmed reduction in inflation as Bitcoin, but a much smoother step reduction per 5 day epoch rather than a large reduction every 2 years. This approach rewards delegators or miners in the early years when the system is becoming established and has higher risks.

Cardano is a tortoise that moves slowly, surely and fairly. Beware the hares, layer 1 blockchains must perform with a very high level of security, reliability and integrity which is not compatible with a “move fast and break things” approach. Especially when tokenomics mean the founders and backers do not actually share the same risk with retail investors.

1As of 16th May 2022 an update has been provided, see below.

2As of 17th May 2022 there are reported rumours that LFG did not sell the BTC but used it to enable whales to exit, see below. If true this would be a very serious violation of trust and ethical behaviour.