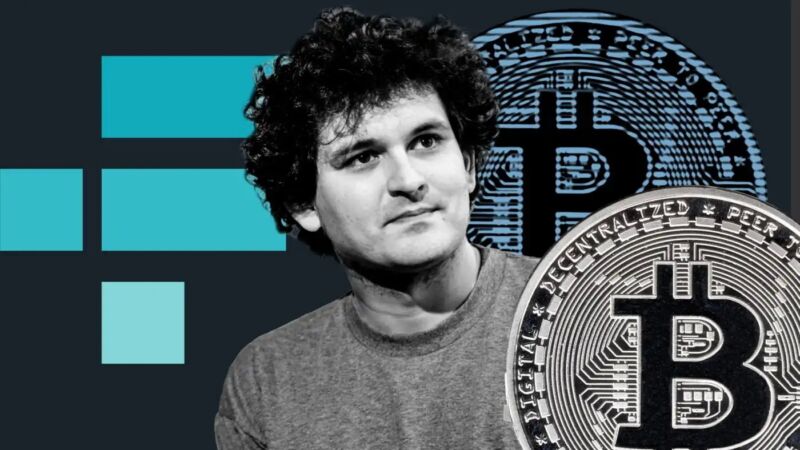

You will likely have seen news over the last few days on the collapse of FTX, the exchange led by Sam Bankman-Fried and the sister company Alameda which was essentially their trading arm. This high profile collapse follows hot on the heels of Terra/Luna (Do Kwon), and Celsius (Alex Mashinsky) and has had similar negative effects on the markets as people have rushed to liquidate assets.

On the face of it you could see this as another resounding failure of crypto and evidence for the need for urgent regulation? Perhaps, however we would suggest the exact opposite. All of these organisations were very similar. They promised outsized and unrealistic returns. These returns were not sustainable and ultimately led to rapid collapse and insolvency (where debts are greater than liabilities) once it became obvious to the wider market. High profile investors should have performed better oversight and due diligence. Retail investors forgot the phrase ‘Caveat Emptor’.

In the immediate aftermath some commentators have mentioned creating bailout funds. We would argue that Crypto does not need bailout funds which distort risk, we are still at an early stage where investors should be aware and sceptical. With power and autonomy comes responsibility. Cautious and informed investors help the market to correct and allow it to sort the good from the bad. While there may ultimately be a place for regulation (or assurance) of entities that behave like banks (custody and management of customer funds), this should be approached carefully as it is far from clear how this can be achieved without stifling innovation.

If you are reading this you are almost certainly a more informed investor. You are likely using self-custody to keep your funds in a wallet like Daedalus that you directly control rather than on an exchange where they can be misused. That’s a good thing that more people should be doing. It promotes decentralisation, and helps make the ecosystem more robust.

Charles Hoskinson makes a few of these points more eloquently than we have in a recent update linked below for convenience.

There is still a long road ahead of us and these recent events may make it harder for legitimate projects in the short term. However we can take some comfort from the fact that the slow and steady approach followed by IOG will help ride the storms. Sometimes the tortoise wins…